What Is a Loan Limit? When contemplating purchasing or refinancing a home in the United States, it’s essential to know the maximum mortgage loan amount, which is determined by the Federal Housing Finance Agency (FHFA). There are limits to how much you can borrow, and staying within these limits is important to ensure that you don’t take on too much debt.

Conforming Loan Limits

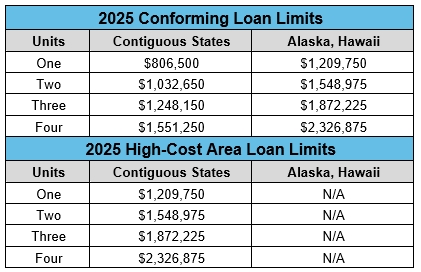

Conforming loan limits are a popular type of mortgage loan limit that applies to conventional loans backed by Fannie Mae and Freddie Mac. For 2023, the conforming loan limits will be $726,200 for most counties but can increase up to $1,089,300 in high-cost areas. It’s important to keep in mind that high-cost loan limits can vary based on the county you are looking to purchase or refinance in. It’s also worth noting that the maximum baseline loan amount for conforming loans can vary based on the number of units in the property. To find out what the loan limit is for your county, please visit the FHFA’s website by clicking here.

If you’re planning to purchase a home with a loan amount that exceeds these maximum limits, you may want to consider applying for a jumbo loan. While jumbo loans have higher limits, they typically have stricter requirements.

FHA Loan Limits

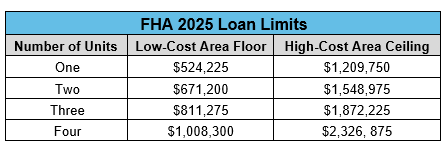

The Federal Housing Administration (FHA) is another government agency that sets mortgage loan limits for loans that it insures. These limits can vary by county and are generally lower than conforming loan limits. For 2023, the FHA loan limits will range from $427,000 to $1,089,300, depending on the county. Keep in mind that the maximum baseline loan amount can also vary based on the number of units in the property.

FHA loans are a popular option for first-time homebuyers and those with lower credit scores. However, they do require mortgage insurance premiums that can increase the overall cost of the loan. It’s important to factor in these additional costs when considering an FHA loan and to compare them to other types of loans that may be available to you. To find out what the loan limit is for your county, please visit the HUD website by clicking here.

In summary, the FHA sets mortgage loan limits for loans that it insures, with limits varying by county and generally being lower than conforming loan limits. FHA loans can be a good option for certain types of homebuyers, but it’s important to understand the additional costs associated with mortgage insurance premiums. By weighing the pros and cons of different types of loans, you can make an informed decision about the best loan option for your needs.

VA Loan Limits

The Department of Veterans Affairs (VA) sets loan limits for VA loans, which are available to eligible veterans, service members, and their spouses. VA loans can be an attractive option for many veterans and active-duty service members due to their lower interest rates and no down payment requirement.

The reason why there is no loan limit for VA loans is due to the VA guarantee. The VA guarantees a portion of the loan, meaning that it will repay a portion of the loan to the lender if the borrower defaults. As a result, lenders can offer VA loans with more favorable terms, which can make them more accessible and affordable for eligible borrowers.

In addition to the favorable terms, the VA guarantee also provides protection for lenders against losses, which allows them to be more flexible with lending standards. This can make it easier for veterans, active-duty service members, and their families to qualify for a VA loan, even if they have lower credit scores or other financial challenges.

It’s important to keep in mind that while there is no official loan limit for VA loans, the VA does set limits on the amount of its guarantee. In most areas of the country, the VA will guarantee up to 25% of the loan amount, up to a maximum of $144,000. However, in high-cost areas, the VA’s guarantee can be higher, which effectively increases the amount that a veteran can borrow without a down payment.

In summary, VA loans are an attractive option for eligible veterans, service members, and their families due to the VA guarantee, which provides protection for lenders and offers more favorable terms. While there is no official loan limit for VA loans, the VA does set limits on the amount of its guarantee, which can vary based on the location of the property being financed. By understanding these loan limits and the unique features of VA loans, eligible borrowers can make informed decisions about their mortgage options.

The Bottom Line

FHFA and FHA maximum loan limits are useful benchmarks for potential homebuyers seeking a mortgage. However, eligibility for such loans is largely dependent on factors like credit score, income, and assets, with lenders using these criteria to assess an applicant’s overall financial health. Thus, while the FHFA’s maximum limit is currently $1,089,300 and the FHA’s is $427,030, these figures are not guarantees of loan approval, but rather serve as starting points for the mortgage application process. Ultimately, the loan amount will be determined by the applicant’s individual financial profile.

If you are interested in determining the approximate amount that you may qualify for when seeking a mortgage, take advantage of our multiple mortgage calculators.